The Hidden Weight of Payroll

The Hidden Weight of Payroll (and Why Most Owners Don’t Talk About It)

Let’s be honest for a second. Payroll looks deceptively simple from the outside.

People work → people get paid.

That’s the fictional version.

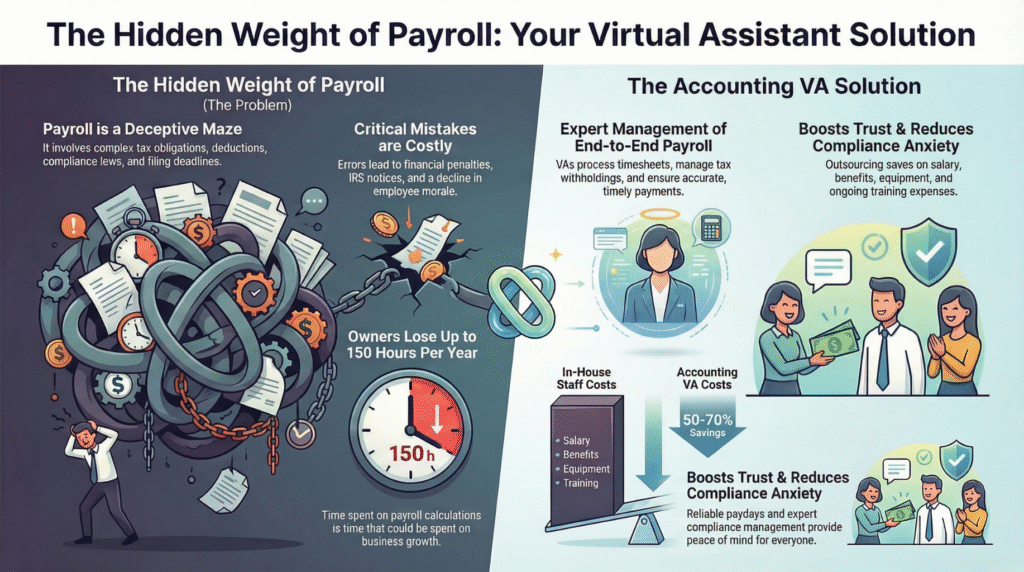

In reality, payroll is a maze of:

- Local, state, and federal tax obligations

- Deductions

- Garnishments

- Benefits adjustments

- Timesheet audits

- Payroll compliance laws

- Filing deadlines

Payroll mistakes can get expensive. Not just financially — emotionally. Employees feeling undervalued or frustrated because their paycheck is wrong? That’s a culture killer.

This is why more companies — from solopreneurs to mid-sized teams — are turning toward an accounting virtual assistant specializing in payroll support. Because the job requires precision, and precision requires focus.

What an Accounting Virtual Assistant Actually Handles in Payroll Support

Most people imagine virtual assistants scheduling emails or doing simple admin tasks. But payroll-focused accounting VAs operate on a completely different tier.

They’re the behind-the-scenes powerhouse keeping your payroll engine humming.

1. Processing Employee Payroll End-to-End

This includes:

- Collecting timesheets

- Verifying work hours

- Calculating overtime and bonuses

- Preparing payroll reports

- Running payroll through your system (Gusto, QuickBooks, ADP, Paychex, etc.)

It’s not “data entry.” It’s orchestrating a workflow that must run perfectly every single time.

2. Managing Tax Deductions and Withholdings

Tax rules change more than most people’s morning routines.

An accounting virtual assistant stays on top of:

- Federal/state/local tax rates

- Benefits deductions

- Retirement contributions

- HSA/FSA rules

- Employee-specific adjustments

They ensure accuracy so you don’t accidentally under- or over-deduct — both of which cause headaches no business owner needs.

3. Ensuring Timely and Accurate Salary Payments

Your VA becomes the guardian of payday.

They monitor:

- Cutoff dates

- Bank processing times

- Holidays

- Time zone differences

And yes, they’re the person who double-checks that everyone gets paid correctly… so you never wake up to a frantic Slack message again.

4. Maintaining Digital Payroll Records

They organize:

- Pay stubs

- Tax filings

- Adjustment logs

- Payroll summaries

This matters for:

- Audits

- Compliance

- Employee questions

- Year-end reporting

Think of them as your payroll librarian, and your library is always filed perfectly.

5. Liaising With HR and Finance Teams

Payroll rarely stands alone.

An accounting virtual assistant supports:

- Onboarding new hires

- Offboarding departing employees

- Updating benefits

- Adjusting payroll classifications

- Coordinating with HR for compliance

They become a connective tissue between departments — smoothing communication, preventing errors, and speeding up transitions.

Why an Accounting Virtual Assistant Is Often Better Than In-House Payroll Staff

Now, this part surprises people.

Hiring an in-house payroll admin sounds ideal… until you compare cost, flexibility, and expertise.

Cost Savings Without Cutting Quality

In-house payroll specialists typically cost:

- Salary ($45k–$70k+ for experienced staff)

- Benefits

- Payroll expenses

- Office equipment

- Ongoing training

An accounting virtual assistant?

Usually 50–70% less — with equal or greater skill.

Instant Access to Specialised Payroll Knowledge

Payroll isn’t one-size-fits-all. It evolves:

- Quarterly

- Annually

- Every time labor laws update

An outsourced professional already knows the systems, pitfalls, and compliance rules. You aren’t paying to “train them up.”

No Single Point of Failure

In-house payroll person calls in sick? Takes PTO? Quits?

Your business stalls.

A payroll-focused virtual assistant firm often has:

- Backup support

- Documented processes

- Emergency cover

Meaning payroll still runs — even when life happens.

Scalable Support as Your Team Grows

Five employees.

Fifteen employees.

Fifty.

Your VA adapts without forcing you to hire or restructure.

The Operational Transformation You Feel Immediately

Here’s where things get real.

Hiring an accounting virtual assistant to handle payroll support creates noticeable shifts inside your business:

1. Your Time Frees Up Dramatically

If you’ve ever delayed payroll until the evening because everything else felt urgent — this is your moment of relief.

Owners report saving:

- 4–12 hours per payroll cycle

- 40+ hours per quarter

- Up to 150 hours per year

That’s time you can redirect into growth instead of calculations.

2. Employee Trust Goes Up

Nothing tells employees “we care” like:

- Accurate pay

- On-time deposits

- Clear communication

People remember bad paydays.

They also remember reliable ones.

3. Compliance Anxiety Drops

A payroll mistake can trigger:

- IRS notices

- State penalties

- Legal issues

- Employee disputes

Your VA acts like your safety net, keeping everything aligned with the latest rules.

4. Financial Forecasting Becomes Easier

Accurate payroll → accurate reporting.

Knowing your true labor costs helps with:

- Budgeting

- Planning

- Cash-flow predictions

It’s the foundation of healthier financial decisions.

A Real-World Example: When Payroll Nearly Broke a Business (and the VA Saved It)

A boutique ecommerce brand with 14 employees reached out because payroll kept slipping through the cracks. Team members were paid on different schedules. Overtime calculations were off. A tax deduction error resulted in a notice they didn’t know how to interpret.

Morale was dropping.

Within six weeks of hiring an accounting virtual assistant:

- All payroll was consolidated onto one system

- Timesheets were automated

- Benefits deduction updates were synced

- A simple two-step approval workflow was introduced

- Employees received clear breakdowns of every check

The tax issue?

Handled, corrected, documented.

The founder said it felt like “the business finally exhaled.”

How to Choose the Right Accounting Virtual Assistant for Payroll

This is where founders either succeed or struggle. Not all VAs are payroll-capable.

Look for:

✔ Payroll system proficiency (Gusto, ADP, QuickBooks, Rippling, Paychex)

✔ Experience with payroll compliance

✔ Understanding of multi-state tax rules (if applicable)

✔ Knowledge of employee classifications (W-2, 1099, contractors, exempt/non-exempt)

✔ Absolute precision and attention to detail

✔ Strong judgment around confidentiality

✔ Clean communication style

✔ Ability to work proactively, not reactively

If a VA hesitates or is vague about payroll experience — keep searching.

The Payroll Framework Used by Top-Tier Accounting VAs

Here’s a quick breakdown of the workflow many elite payroll assistants use behind the scenes:

Step 1 – Time & Data Collection

They gather or verify:

- Timesheets

- Bonuses

- Commission reports

- PTO adjustments

Step 2 – Pre-Payroll Review

They analyze:

- Rate changes

- Tax updates

- Benefits modifications

- Classification shifts

Step 3 – Payroll Processing

They run payroll using standardized procedures to avoid slip-ups.

Step 4 – Post-Payroll Audit

This includes double-checking:

- Payments

- Reports

- Deposits

- Logs

Step 5 – Recordkeeping & Reporting

Everything gets filed neatly for:

- End-of-year

- Audits

- Employee inquiries

This is the stuff that keeps your business clean, clear, and confident.

Frequently asked questions (FAQ)

They manage end-to-end payroll tasks — processing payroll, updating tax deductions, managing benefits adjustments, and ensuring accurate and timely salary payments.

Yes. Reputable accounting VAs follow strict confidentiality protocols, NDAs, secure storage systems, and compliance workflows.

Rates range from $20–$60/hour depending on experience and complexity, with monthly packages available.

Many can. Just verify their experience with multi-state wage laws or international payroll platforms.

Common tools include Gusto, QuickBooks Payroll, ADP, Paychex, Rippling, and BambooHR.

Often within days — sometimes within hours — depending on the error and needed documentation.

Absolutely. In fact, small businesses often benefit the most because payroll consumes a larger percentage of their operational time.